In today’s fast-paced world, managing your finances efficiently is a vital skill. One aspect that often takes center stage in our financial lives is handling recurring expenses. In this article, we’ll explore how to master the art of managing recurring expenses and keep your financial ship sailing smoothly.

Understanding Recurring Expenses

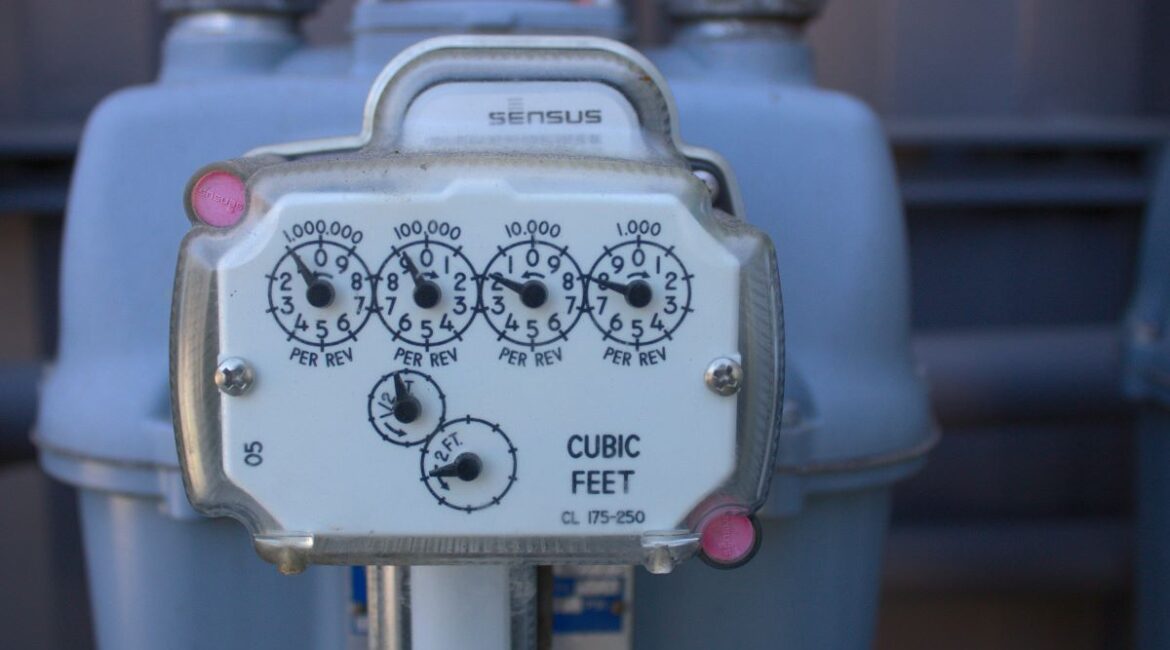

Before delving into the strategies to manage recurring expenses effectively, let’s grasp what recurring expenses are. Recurring expenses are those regular financial obligations that you must pay on a consistent basis, usually monthly or annually. These can include your rent or mortgage, utility bills, insurance premiums, subscription services, and more.

Create a Detailed Expense List

To take control of your recurring expenses, start by creating a detailed list of all your monthly and annual financial commitments. This list will help you get a clear overview of where your money is going and enable you to identify areas where you can make cost-effective changes.

Prioritize Your Expenses

Once you have your list in hand, it’s time to prioritize your recurring expenses. Identify which ones are essential and which are discretionary. Prioritizing allows you to distinguish between needs and wants, helping you allocate your resources more effectively.

Budget Wisely

With your priorities in place, it’s time to create a budget that accommodates your recurring expenses. Allocate specific amounts for each obligation, ensuring that you can comfortably cover them without straining your finances. Remember, a well-structured budget is your financial roadmap.

Seek Cost-Cutting Opportunities

There’s always room for improvement when it comes to reducing recurring expenses. Look for opportunities to cut costs without sacrificing quality or essential services. This could mean negotiating with service providers, seeking more affordable alternatives, or eliminating unnecessary subscriptions.

Automate Payments

One of the most effective ways to ensure you never miss a payment is by setting up automatic payments for your recurring expenses. This not only saves you time and effort but also helps you avoid late fees or penalties.

Regularly Review Your Expenses

Managing recurring expenses isn’t a one-time task. Regularly review your expenses to ensure they align with your financial goals. Be open to making adjustments as your circumstances change.

Emergency Fund for Unforeseen Expenses

Incorporate an emergency fund into your financial plan. This acts as a safety net for unexpected expenses that may arise. Having an emergency fund ensures you won’t need to dip into your budget for sudden financial crises.

Keep an Eye on Your Credit Score

Your credit score can significantly impact your financial stability. Timely payment of recurring expenses can positively affect your credit score, which, in turn, can help you access better financial opportunities and interest rates.

Stay Informed About Financial Products

Stay informed about financial products, such as credit cards, loans, and insurance. Knowing the latest offerings in the market can help you make informed decisions about your recurring expenses.

Conclusion

Mastering the art of managing recurring expenses is a critical step towards financial stability and security. By understanding your financial obligations, prioritizing them, and budgeting wisely, you can take control of your finances and work towards achieving your financial goals. Remember, it’s an ongoing process that requires diligence, but the rewards in financial peace of mind are well worth the effort. So, start implementing these strategies today and watch your financial health improve.