In the fast-paced world of small business financing, choosing the right financial tool can be the difference between thriving and struggling. Small business owners often find themselves at a crossroads, deciding between a Small Business Line of Credit and Credit Cards. Both options have their merits, but understanding when to use one over the other is essential. Let’s delve into the nuances of each to help you make an informed decision for your business.

The Basics

Small Business Line of Credit

A Small Business Line of Credit is a revolving credit facility provided by financial institutions. It works like a safety net, allowing you to borrow up to a predetermined limit. You only pay interest on the amount you use, making it a flexible option. This financial lifeline is perfect for covering operational expenses, inventory, or dealing with unexpected emergencies.

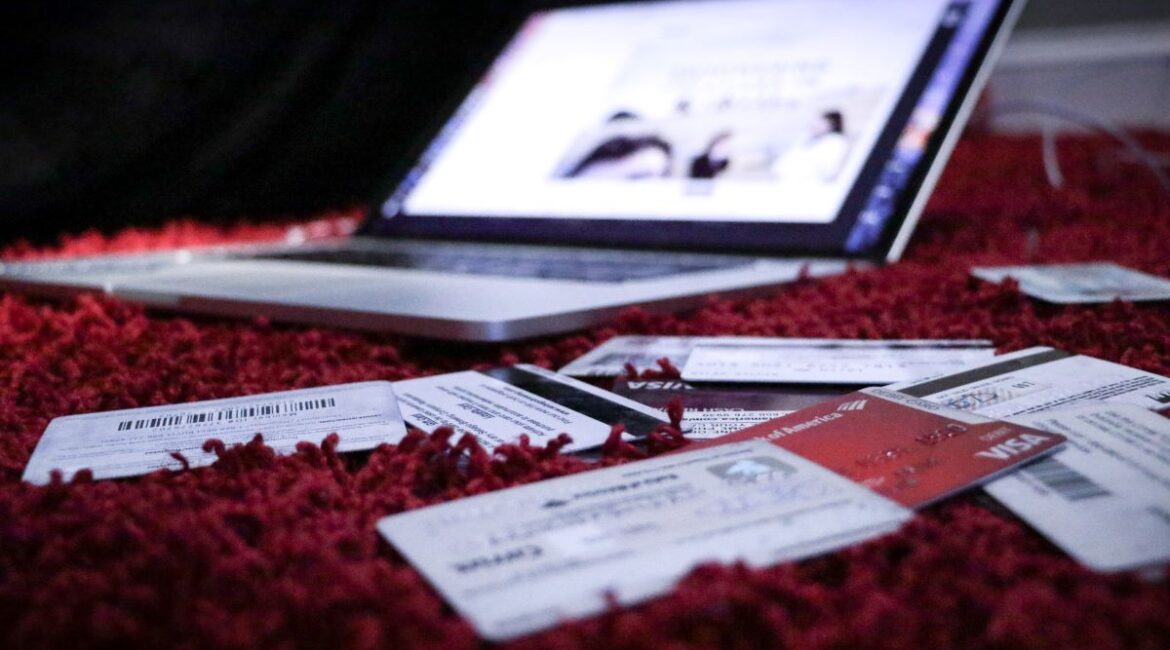

Credit Cards

Credit cards, on the other hand, are widely used for both personal and business expenses. They offer convenience and quick access to funds. With a credit card, you can make purchases, pay bills, and manage your cash flow efficiently.

When to Choose a Small Business Line of Credit

1. Long-term Financing

When your business needs financing for a more extended period, a Small Business Line of Credit is a solid choice. You can access funds repeatedly without the need for reapplying.

2. Lower Interest Rates

Small Business Lines of Credit often come with lower interest rates compared to credit cards, making them a cost-effective option for long-term borrowing.

3. Larger Funding Needs

If your business requires a substantial amount of capital, a line of credit is the way to go. It offers higher credit limits, ensuring you have the financial cushion to grow your business.

4. Building Business Credit

Utilizing a Small Business Line of Credit responsibly can help establish and improve your business credit score, which is crucial for future financing and business growth.

When to Opt for Credit Cards

1. Short-Term Expenses

Credit cards are perfect for covering small, short-term expenses. Whether it’s office supplies or a quick business lunch, credit cards offer the flexibility to manage these costs.

2. Convenience and Accessibility

Credit cards provide immediate access to funds, making them suitable for emergencies or unexpected bills that require rapid payment.

3. Rewards and Perks

Many business credit cards come with rewards programs, offering cashback, travel points, or other perks. If you can benefit from these rewards, a business credit card might be the way to go.

4. Separating Business and Personal Expenses

Using a dedicated business credit card helps keep your business and personal finances separate, making tax reporting and accounting more straightforward.

Conclusion

In the eternal battle of Small Business Line of Credit vs. Credit Cards, there’s no one-size-fits-all answer. The choice depends on your specific business needs, financial goals, and the duration of borrowing. Small Business Lines of Credit are ideal for long-term, larger financing, while credit cards offer convenience and flexibility for shorter-term expenses.

Remember, the key to making the right choice is understanding your business’s unique financial requirements. Evaluate your options carefully, and you’ll be well on your way to managing your finances more effectively and securing the future growth of your business.